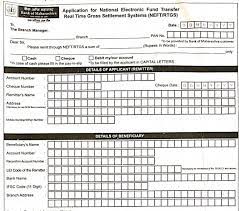

One of India’s public sector banks is the Bank of Maharashtra. The most popular service offered by this bank is online money transfers using RTGS. Real time gross settlement, sometimes known as RTGS, is an online method for moving funds instantly or in real time from one bank account to another. This kind of money transfer is practical, dependable, and secure. One can transfer funds through RTGS starting at Rs 2 Lakh or more. For this service, a little fee is required. Below is an example of a completed RTGS form from the Bank of Maharashtra, along with a detailed explanation of each column that must be filled out.

Download Bank of Maharashtra RTGS Form/Slip

Note:- In order to send money via RTGS, a person must have an account with a certain Bank of Maharashtra branch and must draw a self-check for the specified amount, including bank fees, in order to send the money to the receiving account.

Bank of Maharashtra RTGS/NEFT Form PDF 2025 Download

Office Copy:

- Date: Write the date when you are making the transaction

- Received from: In this coloumn the remitter has to write his account name ( or the name by which is operating this account)

- A/C NO: The remitter has to write his account number from which he has to transfer

- A/C Type ( Saving, Current, CC/OD): Remitter has to choose the type of account he maintain either it is saving account or current account.

- Rupees: Write the amount you are transferring to the sender:- Charges Rs: Write the Bank charge levied on the amount for transfer

- Total Rs: Write the total amount ( addition of Rupees and charges):-

Details of RTGS centre and beneficiary as under:

- Beneficiary Name: Write the bank account name of the person to whom you are transferring the money

- Bank Name: Write the funds Receiver Bank name

- Branch Name: Write the funds Receiver Bank branch name

- Account type and NO: Write the bank account number and account type ( either saving or current) of the person who is receiving the funds

- IFSC Code: Write the IFSC code of the bank Branch of the receiver of funds

- City: Name of the city where the receiver of funds has his home branch

Applicant’s signature & Cell No: The sender of funds has to write his name along with his mobile numberBranch Seal and Sign Authorised Signature : Leave this coloumn Blank

Branch Copy:

- Date: Write the date when you are making this transaction

- The Manager: Write the name of the Branch where you are making the transaction

- Please remit a sum of Rs.: In this coloumn write the total amount in Figure including the charges

- Rupees: Write the total amount you are remitting in words

Details of RTGS centre and beneficiary as under

- Beneficiary Name: Give the name of the person whose bank account you are transferring money.

- Bank Name: Enter the money recipient bank name

- Division Name: Summon the money Name of the Receiver Bank Bank Branch

- Type of account and NO: Take down the recipient’s name, bank account number, and account type (savings or current).

- The IFSC code Write the Branch’s IFSC code for the money recipient.

- City: City name where the recipient of the cash has a primary branch

Candidate’s signature and cell number: The person sending the money must provide both his name and his cellphone number.

Official Signature: Keep this column blank Blank

Note: After adding an approved bank signature and a bank seal, the bank returns the office copy to the sender as the receiving copy while keeping the bank copy from the above form.