Online banking has merged seamlessly into everyone’s daily lives. The vast majority of the job was moved online when a pandemic broke out. In order to free themselves from having to handle banking duties, all banks began offering online services.

When services are offered online, complaints will always be there as machines that govern everything. As a result, the banks must establish enough grievance redressal cells where customers may file complaints so that the banks can investigate them and take appropriate corrective action.

How To Lodge Complaint In IDBI Bank Online

PORTAL (www.pgportal.gov.in). Aggrieved customers may lodge their complaint to Government of India through online Public Grievance Lodging and Monitoring System available on website (www.pgportal.gov.in).

A committee set up by the RBI made the recommendation that IDBI increase its scope of operations and combine the responsibility for developing finance and other activities by departing from the established norms of commercial banking and developmental banking.

IDBI changed its position from a development finance institution to a commercial organisation in order to keep up with the financial sector reforms brought about by the government’s initiatives and to advance India’s economy.

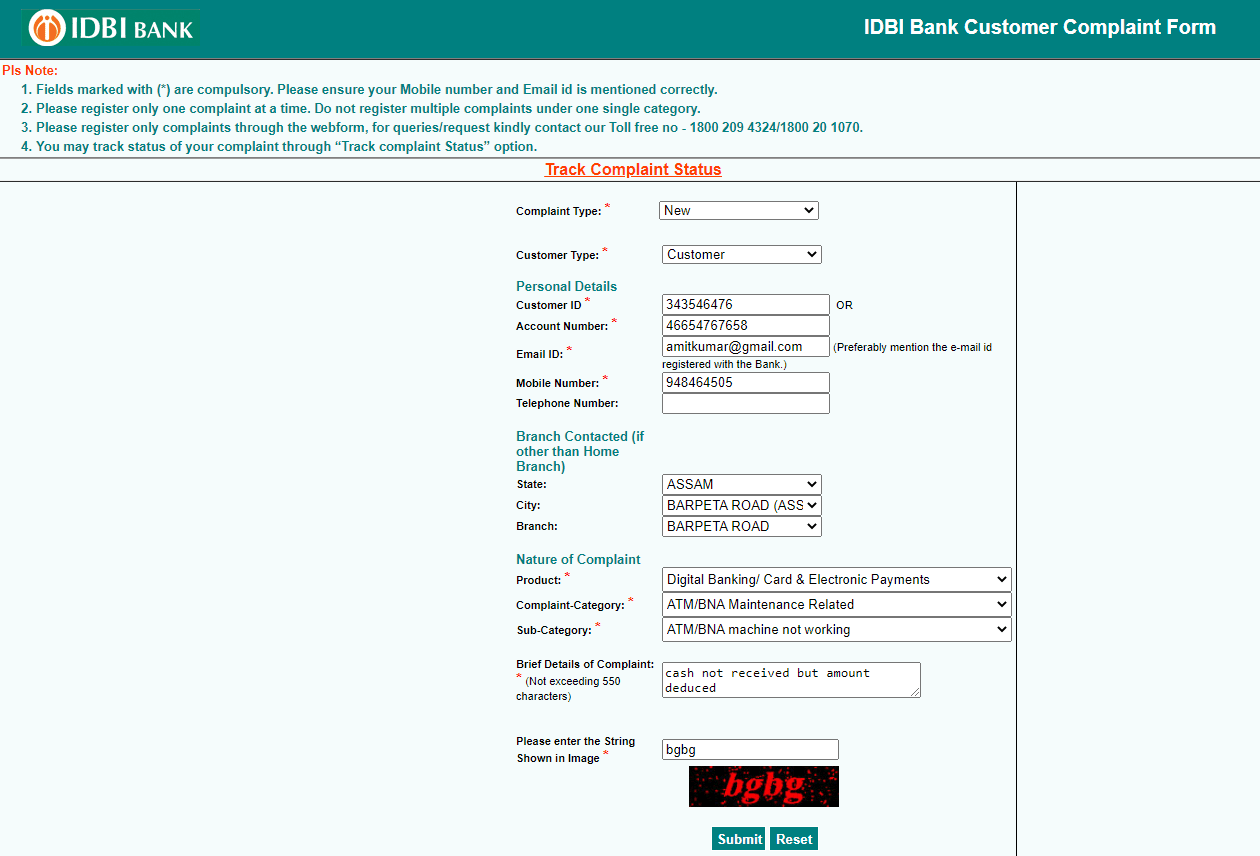

Because there are many potential issues with online transactions, the following stages should be followed when submitting an online complaint to IDBI Bank.

Level 1

- The IDBI online CRMS portal’s complaint form must first be filled out there.

- If you’re not happy with the response, you may also send them an email at the address shown on the IDBI customer service website. CustomerCare@idbi.co.in is my email address.

- Even if you still haven’t received your registration ID after 8 working days, you may monitor your complaint using the website’s URL. The grievance redressal cell excels at responding to you within the allotted period.

However, you always have the choice to contact the authorities, who are in charge of addressing the problems, via toll-free lines 1800-209-4324/1800-22-1070. In the event that something goes wrong, they will also assist you in filing the complaint online and streamline the procedure.

| Services | contact |

|---|---|

| Complaint Toll-free Number | 1800-209-4324 or 1800-22-1070 |

| Non-Toll Free Number | 022-67719100 |

| NRI Complaint Number | +91-22-67719100 |

| Complaint through SMS | SMS “IDBICARE” to 9220800800 |

| customercare@idbi.co.in |

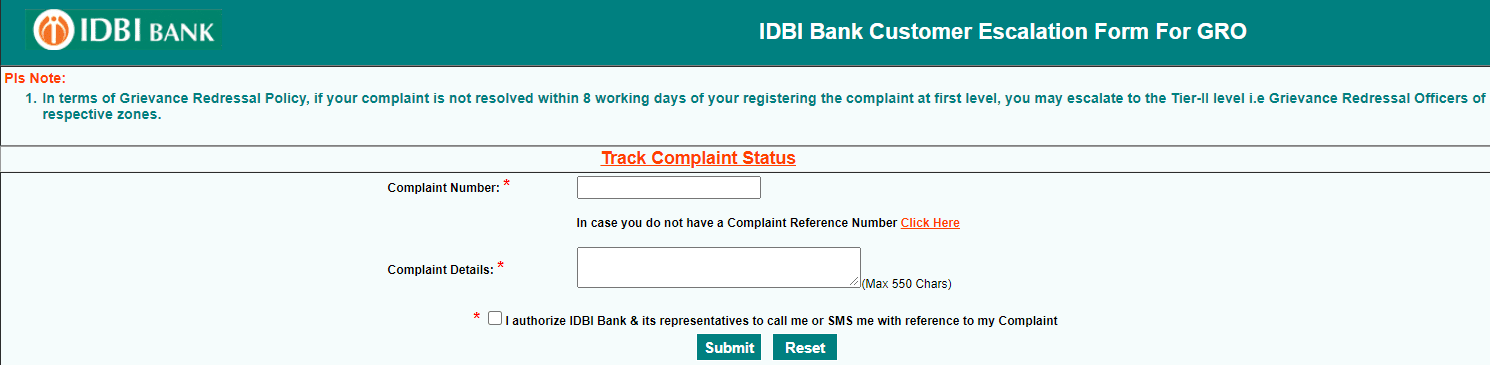

LEVEL 2: Grievance Redressal Officer Complaints

You may speak with the Grievance Redressal Officers during IDBI bank office hours if your issue is not handled within 8 working days.

- Visit the official GRO URL at https://crmsonline.idbibank.com/grocomplaintform.aspx to file a complaint there.

- Click the submit button after entering the complaint’s information and complaint number.

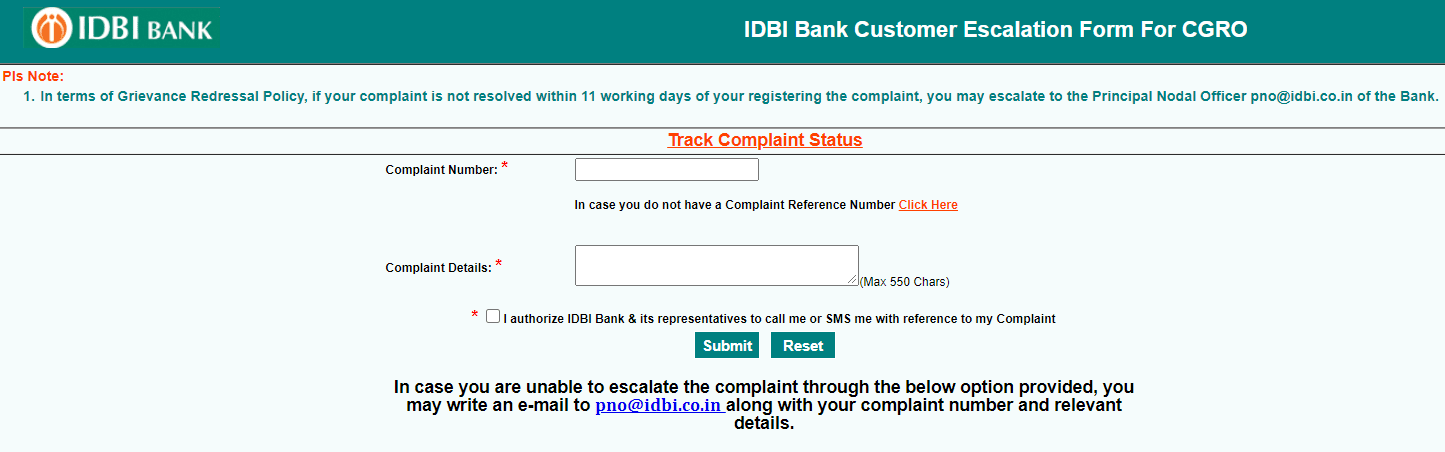

LEVEL 3: Principal Nodal Officer Complaint

You may contact the Principal Nodal Officer if your complaint is not handled after 11 working days of filing it with GRO. You can submit online by following the procedures below or by emailing pno@idbi.co.in directly:

- Go to https://crmsonline.idbibank.com/cgrocomplaintform.aspx to access the PNO link.

- Put in your complaint’s information and complaint number.

- After agreeing to the conditions, press the submit button.

You may always escalate the issue by filling out the form on the Reserve Bank of India website, which requests your personal information, transaction Id, and contact data to provide a personalised experience and aid in the problems’ better resolution.

If you want to submit the form for problem escalation, you must provide the following details: your account number or customer ID, contact information (address, phone number, and email), and the reference number of the transaction or complaint.

Conclusion

Unresolved complaints might harm the bank’s reputation, which is bad for all banks. As they trust the banks with their hard-earned money and life savings, customers’ confidence is extremely vital to the banks.

Since it increases trust and promotes the reputation of the bank, it cannot be seen with the unaided eye. It aids them in creating a faith- and trust-based empire. Therefore, even a small scratch might have a major impact on their market share.

Due to the difficulty of handling issues offline, the grievance redressal process must be robust enough to ensure that clients do not have issues while dealing with a pandemic.

FAQ

How can I raise my complaint in IDBI Bank?

- Toll Free numbers: 1800-209-4324/1800-22-1070.

- Non Toll Free Number: 022-67719100.

- Contact number for outside India customers: +91-22-67719100.

- Debit Card Hot listing number: 1800-22-6999.

How do I email a bank complaint?

- Alternatively, an email can be sent to crpc@rbi.org.in.

How do I file a complaint against a bank?

- Lodge your complaint with the Banking Ombudsman of Reserve Bank of India. You can fill up this online complaint form with details of complaint, bank’s name against whom you wish to file a complaint, phone numbers, bank account details, etc.

What is the Gmail ID of IDBI Bank?

- In case of suspicion, report the matter immediately to us on our toll free 24 hour customer care numbers or email us at customercare@idbi.co.in .

How do I write a letter of complaint to a bank?

- I wish to complain about ____ (name of product or service, with serial number or account number) that I purchased on ____ (date and location of transaction). I am complaining because ____ (the reason you are dissatisfied). To resolve this problem I would like you to ____ (what you want the business to do).

How do I write a letter of complaint?

Information To Include in Your Letter

- Give the basics.

- Tell your story.

- Tell the company how you want to resolve the problem.

- Be reasonable.

- File your complaint.

- Your Address.

- Your City, State, Zip Code. [Your email address, if sending by email]

- Date.